Are Gen Zs too cool to carry cash: Rise of UPI in India

Article By – Jasmine kaur

A systematic transformation into a cashless and digitalised economy from a cash economy.

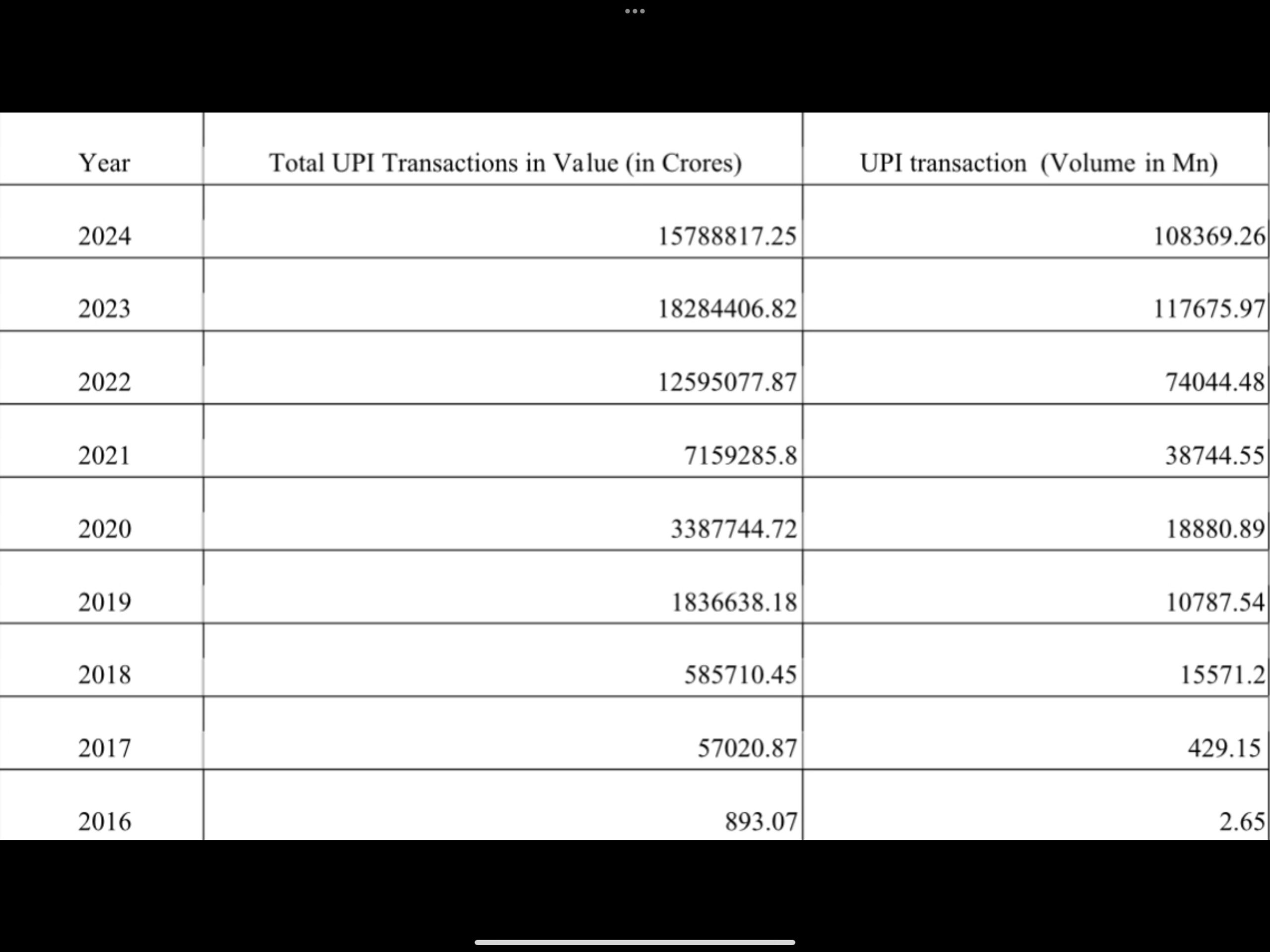

The Unified Payments Interface (UPI) has experienced remarkable growth in both transaction volume and value from its inception in 2016 to 2024. Launched by the National Payments Corporation of India (NPCI), UPI has revolutionized digital payments by enabling real-time, bank-to-bank transfers.

Starting with just 2.65 million transactions worth ₹893.07 crores in 2016, UPI has continuously expanded. By 2024, annual transactions are expected to surpass 108 billion, with a total value exceeding ₹1,57,88,817.25 crores. This rapid growth underscores UPI’s widespread adoption across industries and its increasing significance in facilitating high-value digital transactions.UPI has gained widespread popularity for offering a seamless digital payment platform, with various UPI apps attracting users through their unique features and functionalities. It represents a significant advancement over existing payment systems and has the potential to provide India with a robust digital payment infrastructure in a highly cost-effective manner. Reports indicate that India has emerged as a global leader in real-time payment solutions, thanks to UPI technology, prompting several other countries to explore and adopt its successful model in their own payment ecosystems.

The banking industry is undergoing a financial transformation driven by the rapid advancement of technological applications. These innovations compel banks to adopt digital solutions that enhance customer convenience and offer personalized services. The introduction of new technologies, the launch of innovative financial products, and the rise of tech-driven competitors are key factors fueling the rapid expansion of digital payment platforms. These digital payment methods are reshaping the banking sector by creating a more transparent and user-friendly transaction environment, enabling instant, real-time payments without the delays associated with traditional paper-based systems.The Digital India initiative has compelled the banking sector to adopt a digitally integrated ecosystem, emphasizing a paperless and cashless economy. As a result, various digital payment methods have emerged within the banking landscape, with the Unified Payments Interface (UPI) being a prominent example.

Paytm, a popular mode of online payment

Paytm, a popular mode of online payment

COVID-19, Demonetisation and the positive acceleration of UPI growth: a statistical analysis

- The rapid growth of UPI continued as the COVID-19 pandemic accelerated the shift toward contactless transactions, pushing monthly transaction volumes beyond 2 billion by the end of 2020. By 2024, UPI is projected to exceed 12 billion transactions per month, reflecting an astounding 1,100% increase in just five years. This surge has been driven by factors such as ease of use, government initiatives promoting digital payments, and the rising penetration of smartphones in India.

- In terms of transaction value, UPI has witnessed even more dramatic growth. In 2019, the total annual transaction value ranged between ₹18 to ₹22 lakh crore (approximately $240 billion). By the end of 2023, this figure had soared to nearly ₹150 lakh crore ($2 trillion), marking an extraordinary increase of 730-860% over five years. Projections for 2024 suggest that transaction values could surpass ₹175 lakh crore, underscoring not just a rise in transaction volume but also an increase in the value of goods and services exchanged via UPI.

- Annual transaction volume data further highlights UPI’s impressive expansion. In 2019, UPI recorded approximately 12 billion transactions annually, a number expected to reach 140 billion by 2024—an increase of over 1,050%. This transformation demonstrates how UPI has evolved from a niche payment method to an integral part of everyday financial transactions across India. The sharp rise in both monthly and annual transactions emphasizes UPI’s crucial role in bridging traditional banking services with a digital-first economy.

A key driver of this exponential growth has been UPI’s expanding integration across multiple economic sectors. Initially focused on person-to-person transfers, UPI now facilitates business-to-consumer (B2C) and even government payments, significantly broadening its scope and impact. The integration of UPI with various merchant platforms has further amplified its usage, solidifying its position as a cornerstone of India’s digital payment ecosystem.

UPI Transaction Value and Volume in India’s Retail Digital Payment Features of UPI

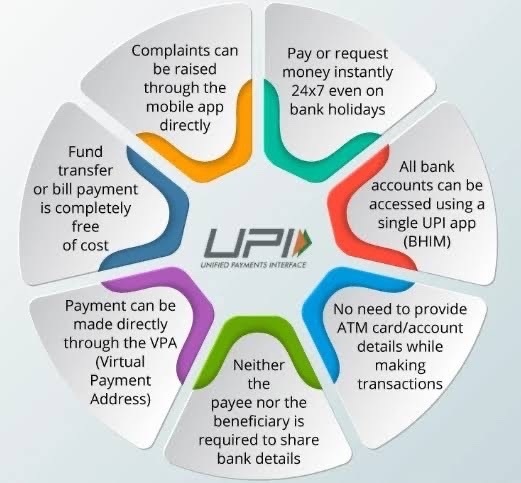

Features of UPI

How is the Indian Government promoting a cashless society?

UPI widely accepted a mode of payment ranging from our local vegetable seller to a fancy five-star accommodation. This became possible due to the rapid adoption and accessibility of smartphones, the rise of e-commerce platforms, government push towards digitalization and the widespread availability of affordable internet services in India.The National Payments Corporation of India (NPCI) was established in April 2009 to develop a unified payment system with the objective of making transactions simple, secure, and interoperable. By 2011, it became evident that India required a more efficient system for handling non-cash transactions, as the average number of such transactions per person was only six per year.

On April 11, 2016, the Reserve Bank of India (RBI) and NPCI officially launched the Unified Payments Interface (UPI) to streamline digital payments and enhance financial inclusion. While its initial adoption was slow, UPI quickly gained momentum as users recognized its convenience for seamless money transfers. The system operates on a four-pillar model, comprising the remitter, the beneficiary, the remitter’s bank, and the beneficiary’s bank. This structure ensures secure and efficient transactions, where the remitter initiates a payment, their bank processes it, and the beneficiary’s bank credits the amount to the recipient’s account.

The Indian government actively promotes the use of digital technologies through various initiatives like Digital India, Make in India, and Startup India. According to a report by the Internet and Mobile Association of India, the number of internet users in India is expected to reach 800 million by 2023. This increase in internet users has also led to an increase in the number of mobile wallet users in India, which is expected to reach 900 million by 2025.The DigiDhan Mission has focused on establishing a robust digital infrastructure for financial transactions. To promote digital payments, the government has introduced various initiatives, including the Aadhaar-enabled payment system.A key objective of the mission has been to increase digital transaction volumes in India. The government initially set a target of 25 billion digital transactions by March 2018, which was significantly surpassed, reaching 40 billion transactions. The DigiDhan Dashboard offers insights into the volume and value of digital transactions across different payment methods, including UPI, debit cards, and credit cards. It also allows users to access their transaction history, enabling them to track past digital payments.Additionally, several initiatives have been launched to expand digital payments in rural areas, such as the establishment of Common Service Centers (CSCs) that provide digital services to citizens in remote regions.

Under the 2025 Indian Budget,The National Payments Corporation of India (NPCI) issued a circular announcing that, effective 1st February 2025, all transactions containing special characters will be declined by the central system .Dated 9 January 2025, the circular instructed UPI ecosystem participants to generate UPI transaction IDs using only alphanumeric characters to align with UPI technical specifications. The government plans to streamline the Know Your Customer (KYC) procedures, making it easier for individuals and businesses to access digital payment systems. This move aims to enhance the adoption of digital transactions across various sectors. Recognizing the pivotal role of Micro, Small, and Medium Enterprises (MSMEs) in the economy, the budget 2025-26 proposes measures to integrate these enterprises into the digital ecosystem. This includes promoting the use of digital payment methods among MSMEs to facilitate seamless transactions and improve operational efficiency.

Online payments is now an integral part of Indian everyday life

Online payments is now an integral part of Indian everyday life

Future of UPI in India-

UPI 2.0, an upgraded version of the system, introduced new features to enhance convenience, flexibility, and security for digital transactions. Additionally, UPI 123PAY was developed as a groundbreaking initiative to make digital payments accessible to everyone, including those without smartphones. Designed for seamless integration with feature phones, UPI 123PAY allows users to make payments through various methods such as missed calls, app-based functionality, and sound-based proximity data communication.To accommodate India’s diverse population, UPI 123PAY supports multiple languages and includes voice-based payment functionality. Using Interactive Voice Response (IVR) technology, users can complete transactions through simple voice commands, making digital payments more accessible to individuals who may not be tech-savvy.

Why do some people still opt for cash-only payments?

UPI Usage and Banking Challenges-

Consumers are increasingly relying on UPI for small-value transactions, reducing the need for physical cash. Different apps and banks impose varying limits on UPI transactions, creating confusion for users.These restrictions affect transaction volume and value, limiting users’ ability to make payments as needed. Some areas also face network hindrances which further hamper the smooth functioning of online payment. Many banks struggle to upgrade their systems and face difficulties in scaling their infrastructure and technical know-how to accommodate the growing UPI transaction load, leading to failed transactions. The rise in UPI usage has also led to an increase in cyber threats and fraudulent activities. Banks have implemented strong security measures, such as encryption, two-factor authentication, and advanced fraud detection, to protect users from unauthorized access and financial fraud. Users must be sensitive and made aware of the security vulnerability that they might face whilst making digital payments.

Conclusion–

Now you don’t have to carry bulky wallets and fret about change or plastic cards to make payments.Online transactions not only streamline transactions but also reduce the substantial costs associated with printing currency and other physical operations associated with money-making and managing.Users can conduct transactions 24/7, completely removing the limitations of traditional banking hours. Additionally, UPI’s effortless transfers across various banks and payment apps enhance financial inclusion by connecting urban and rural areas.UPI has made life faster, easier, more convenient and more efficient. This is likely why several countries, including Singapore, the UAE, and France, have signed agreements with India and are set to introduce UPI in their regions soon.According to a report by Paytm, UPI is expected to account for 90% of retail transactions by 2028. What’s even more remarkable is that countries such as Bhutan, Oman, the UAE, the UK, and several Southeast Asian nations have partnered with Indian organizations like NPCI and BHIM-UPI to streamline transactions.

Quiz yourself –

If you frequently use online payment methods in your daily life, it’s essential to be familiar with the full forms of these abbreviations: QR Code, KYC, UPI, PAYTM, PSP, PIA, EOM, CHQ, IBP, BHIM UPI, YONO, GPAY, and ATM.

Bibliography-

- Seena Mary Mathew, Shanimon.S, Sarvy Joseph, Minija Abraham (2024 Exploring the Exponential Growth of UPI in India: A Study on Digital Payment Transformation (2016–2024). Library Progress International, 44(3), 10796-10805.

- Upes. (2025, May 2). The rise and rise of UPI. Upes.

- Digital Payments driving the growth of Digital Economy | National Informatics Centre | India. (n.d.). https://www.nic.in/blog/digital-payments-driving-the-growth-of-digital-economy/

https://sleepyclasses.com/upi-all-you-need-to-know-about-indias-payment-system